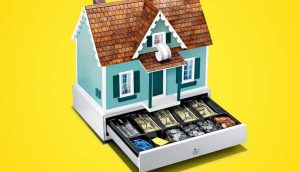

Apply for a Reverse Mortgage: A Step-by-Step Guide to Unlocking Your Home’s Value

As you enter retirement, you may start looking for ways to supplement your income, cover healthcare expenses, or simply enjoy a more comfortable lifestyle. One option worth considering is a reverse mortgage. If you've heard about reverse mortgages but aren't sure where to start, this guide is for you. In this article, we will walk you through the process of how to apply for a reverse mortgage, who qualifies, and what you need to know before moving forward. With Opulence Home Equity, you'll have the confidence of knowing that you're working with a trusted, experienced lender who prioritizes your financial well-being.

Verify my mortgage eligibility (Mar 3rd, 2026)Verify my reverse mortgage eligibility!

What Is a Reverse Mortgage?

A reverse mortgage is a type of loan available to homeowners aged 62 or older that allows them to convert part of their home equity into cash. Unlike a traditional mortgage, where you make monthly payments to a lender, a reverse mortgage provides you with payments, either in a lump sum, line of credit, or monthly installments, depending on the terms you choose.

The best part? You don't have to repay the loan until you sell the home, move out permanently, or pass away. The loan is usually repaid from the sale of the home. The key here is that a reverse mortgage can be a powerful financial tool to help seniors cover living expenses or unexpected costs in retirement.

Verify my mortgage eligibility (Mar 3rd, 2026)At Opulence Home Equity, we specialize in helping seniors like you explore the best reverse mortgage options tailored to your needs. We are dedicated to guiding you through the process and ensuring your financial security for the future.

Who Can Apply for a Reverse Mortgage?

Before diving into how to apply for a reverse mortgage, it's important to understand the eligibility criteria. Not everyone qualifies for this type of loan. Here are the key requirements:

- Age Requirement: You must be at least 62 years old to apply for a reverse mortgage. The older you are, the more you may be eligible to borrow.

- Home Ownership: You must own your home outright or have a significant amount of equity built up. Typically, you should have at least 50% equity in your home to qualify.

- Primary Residence: The home you are using for the reverse mortgage must be your primary residence. You cannot use a second home or rental property to apply for this loan.

- Financial Assessment: Lenders will assess your financial situation to ensure you have enough income to cover ongoing expenses such as property taxes, homeowner's insurance, and maintenance.

At Opulence Home Equity, we will assess your unique situation to provide the best possible guidance through each step, ensuring your financial needs are met while staying in your beloved home.

Verify my mortgage eligibility (Mar 3rd, 2026)Verify my reverse mortgage eligibility!

How to Apply for a Reverse Mortgage

Now that you know the basic qualifications, let's break down the steps on how to apply for a reverse mortgage.

1. Research and Choose the Right Lender

The first step is researching and selecting a lender that offers reverse mortgages. Not all financial institutions provide this type of loan, so it's important to choose a reputable company that specializes in reverse mortgages. Opulence Home Equity is a trusted and experienced reverse mortgage lender, providing personalized service and ensuring that each client feels empowered throughout the process.

Verify my mortgage eligibility (Mar 3rd, 2026)Look for lenders, like Opulence Home Equity, who are approved by the Federal Housing Administration (FHA) to offer Home Equity Conversion Mortgages (HECM), which are the most common and federally insured type of reverse mortgage.

2. Get Reverse Mortgage Counseling

Before you can officially apply, the U.S. government requires that you attend a counseling session with a HUD-approved counselor. This session is designed to help you understand the terms, conditions, and responsibilities of taking out a reverse mortgage. The counselor will also explain other options that may be available to you, ensuring you are making an informed decision.

At Opulence Home Equity, we encourage our clients to make the most of this session and come prepared with questions. This step ensures that seniors are fully aware of how a reverse mortgage works and what to expect.

Verify my mortgage eligibility (Mar 3rd, 2026)3. Submit Your Application

Once you've completed counseling, you can submit your application. Be prepared to provide personal information such as your Social Security number, proof of age, and documentation to verify your homeownership. Your lender will also conduct an appraisal of your home to determine its current value.

At Opulence Home Equity, we simplify the application process, ensuring that you have all the assistance you need in gathering documentation and submitting your application. Our goal is to make it as easy as possible for you.

4. Wait for Loan Approval

After submitting your application and completing the necessary paperwork, your lender will review all the information to determine if you qualify for the reverse mortgage. They'll evaluate the appraised value of your home and decide how much you're eligible to borrow.

Verify my mortgage eligibility (Mar 3rd, 2026)This waiting period can vary, but once you're approved, you'll move on to the next step, which is deciding how to receive your funds. At Opulence Home Equity, we keep you informed during every stage of the approval process, ensuring there are no surprises and you are comfortable moving forward.

5. Choose Your Payment Plan

One of the advantages of a reverse mortgage is that you can choose how you want to receive your funds. There are several options available:

- Lump sum: Receive the full loan amount at once.

- Monthly payments: Get regular payments over a set period or as long as you live in the home.

- Line of credit: Access the funds as needed, which allows you to use only what you require and leave the rest for future use.

This flexibility makes a reverse mortgage appealing to many retirees looking for customized financial solutions. At Opulence Home Equity, we work closely with you to choose the plan that best suits your financial goals.

Verify my mortgage eligibility (Mar 3rd, 2026)6. Close the Loan

Once your loan is approved and you've selected your payment plan, it's time to close the loan. This step involves signing all the necessary documents and agreeing to the terms laid out by the lender. Your lender will explain the details, including fees, interest rates, and repayment terms. Make sure to ask any remaining questions before signing.

At Opulence Home Equity, we are committed to full transparency during the closing process, ensuring you understand the terms and have no hidden fees.

Why Choose Opulence Home Equity?

Applying for a reverse mortgage can be a life-changing decision. With Opulence Home Equity by your side, you'll receive expert guidance from a lender who is dedicated to your financial future. Our personalized approach ensures you're comfortable with every step, and we're here to help you navigate the complexities of a reverse mortgage with ease.

Verify my mortgage eligibility (Mar 3rd, 2026)We pride ourselves on offering flexible payment options and competitive rates, while always prioritizing the needs of our clients. Whether you want to supplement your retirement income or unlock the equity in your home for other needs, Opulence Home Equity is here to make the process simple and stress-free.

Verify my reverse mortgage eligibility!

Is a Reverse Mortgage Right for You?

Applying for a reverse mortgage can provide financial relief during your retirement years. It's a powerful tool for those who wish to stay in their homes while accessing the equity they've built up over time. However, it's crucial to thoroughly understand the process and consult with a trusted lender.

Opulence Home Equity is here to guide you through the entire process. If you believe a reverse mortgage could benefit your financial situation, take the next step and apply for a reverse mortgage today. With the right guidance and planning, you can unlock the value of your home and enjoy a more secure retirement.